The Weekly Update

Week of February 3rd, 2020

By Christopher T. Much, CFP®, AIF®

The Week on Wall Street

Stock benchmarks declined for a second straight week as coronavirus news tempered risk appetite.

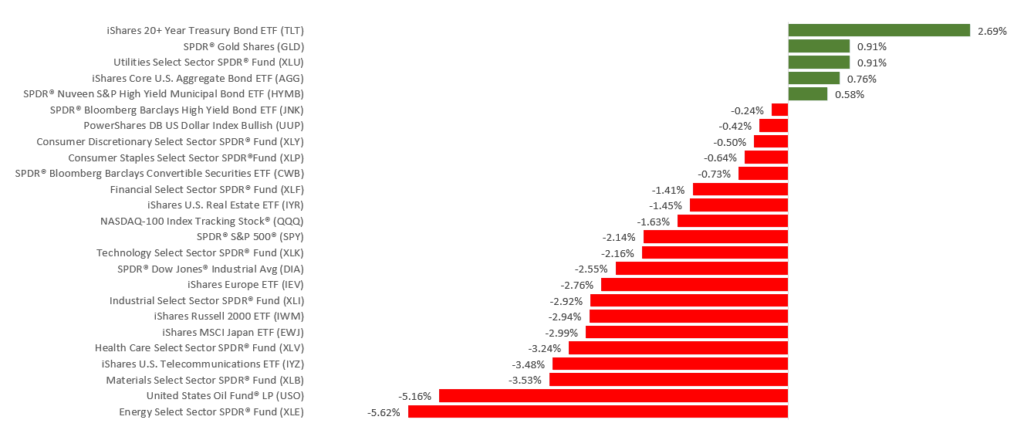

The S&P 500 fell 2.14% on the week. The Nasdaq Composite dipped 1.76%, and the Dow Jones Industrial Average, 2.55%. Away from North America, developed markets slumped 2.24%, according to MSCI’s EAFE index.

The Fed Makes a Minor Move

The Federal Reserve left short-term interest rates alone at its January meeting, but it did make what Fed chairman Jerome Powell called a “small technical adjustment” in view of its continuing purchases of Treasuries. Wednesday, it slightly increased the interest rate paid to banks that park excess capital reserves at the Fed.

The move may give the Fed a bit more control over short-term rates this quarter and assist the operations of U.S. financial markets.

Encouraging New Consumer Data

Rising to 131.6 in January, the Conference Board’s Consumer Confidence Index reached its highest level since August. Consumer spending increased 0.3% in December, according to a new Department of Commerce report.

Economy Expanded at a 2.1% Pace in Fourth Quarter

The Bureau of Economic Analysis released this estimate Thursday. That number matches the gross domestic product of the third quarter and affirms that the U.S. avoided a fall slowdown.

THE WEEK AHEAD: KEY ECONOMIC DATA

Monday: The latest snapshot of factory sector health from the Institute for Supply Management, presenting January data.

Wednesday: ISM’s January report on the state of non-manufacturing businesses and the latest private-sector payrolls report from Automatic Data Processing (ADP).

Friday: The Department of Labor releases its January employment report.

Source: MarketWatch, January 31, 2020

The MarketWatch economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Monday: Alphabet (GOOG), Sysco (SYY)

Tuesday: BP (BP), Fiserv (FISV), Gilead Sciences (GIL), Walt Disney (DIS)

Wednesday: GlaxoSmithKline (GSK), Merck (MRK), Qualcomm (QCOM), Toyota (TM)

Thursday: Bristol-Myers Squibb (BMY), Cigna (CI), Philip Morris (PM), Sanofi (SNY)

Friday: AbbVie (ABBV), Honda (HMC), Novo Nordisk (NVO)

Source: Zacks, January 31, 2020

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.