The Weekly Update

Week of June 28th, 2021

By Christopher T. Much, CFP®, AIF®

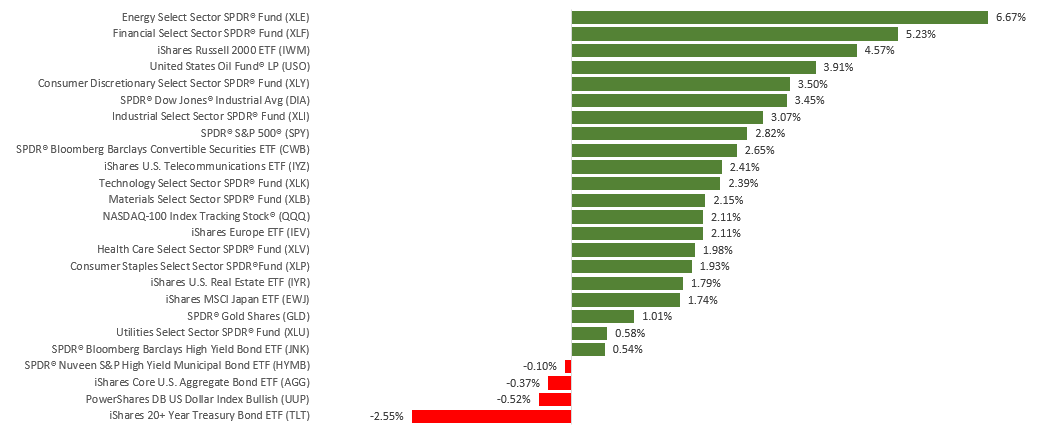

Stocks reached new all-time highs last week as markets staged a strong rebound from the previous week’s declines.

The Dow Jones Industrial Average rose 3.44%, while the Standard & Poor’s 500 picked up 2.74%. The Nasdaq Composite index increased 2.35%. The MSCI EAFE index, which tracks developed overseas stock markets, gained 0.97%.

Stocks Climb

Stocks rallied on the first day of trading last week and gained further momentum on Thursday and Friday. Despite some discouraging data on housing and initial jobless claims, stocks managed to set new highs, as investors cheered an agreement between President Biden and a group of senators that appeared to pave the way for the passage of a $1 trillion infrastructure bill.

Positive results from the Federal Reserve’s stress tests of banks, which raised the prospect of banks raising their dividend payouts and share buybacks, and a key inflation measure coming in at market expectations provided impetus for further gains. The S&P 500 had its best week since February and ended the five-trading days at a record high.

Housing Headwinds

Historically low mortgage rates, the COVID-19 pandemic, and a flush consumer have contributed to a very strong housing market in recent months. Last week’s housing data for May, however, showed that housing may be running into headwinds. The rising cost of materials and labor led to a 5.9% decline in new single home sales in May even as the median price hit an all-time high.

Meanwhile, sales of existing homes fell 0.9%, the fourth-straight month of declines, owing to a very low inventory. High demand, coupled with a depressed supply, led to a 23.6% increase in the median price of an existing home.

This Week: Key Economic Data

Tuesday: Consumer Confidence

Wednesday: ADP (Automated Data Processing) Employment Report.

Thursday: Jobless Claims. ISM (Institute of Supply Management) Manufacturing Index.

Friday: Employment Situation Report. Factory Orders.

Source: Econoday, June 25, 2021

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Wednesday: Micron Technology, Inc. (MU), Constellation Brands, Inc. (STZ), General Mills, Inc. (GIS).

Thursday: Walgreens Boots Alliance, Inc. (WBA), McCormick & Company, Inc. (MKC).

Source: Zacks, June 25, 2021

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.