The Weekly Update

Week of August 2nd, 2021

By Christopher T. Much, CFP®, AIF®

The stock market posted small losses last week despite a very strong showing by corporate America.

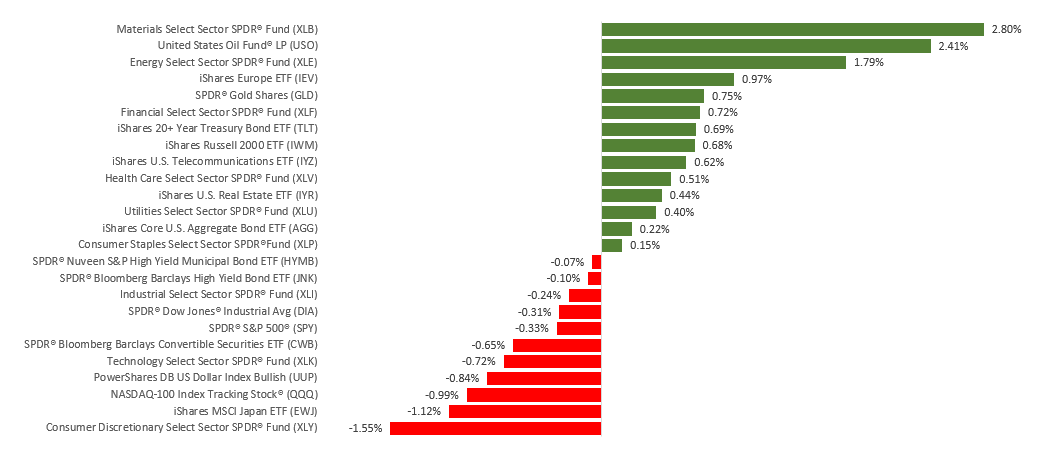

The Dow Jones Industrial Average slipped 0.36%, while the Standard & Poor’s 500 lost 0.37%. The Nasdaq Composite index dropped 1.11% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, jumped 1.51%.

Stocks Take a Breather

There were plenty of excuses for stocks to retreat last week. News of a new phase in Chinese regulators’ crackdown on large, private-sector companies, a decline in new home sales, and concerns about the Delta variant weighed on investors.

After opening the week adding to record highs, stocks turned lower despite an earnings season that continued to impress.

Solid earnings from the mega-cap technology companies were not enough to propel stocks higher. Instead, stocks slipped throughout the week, fighting uncertainty over Chinese stocks, a disappointing second-quarter Gross Domestic Product number, and a retreat in technology shares they reset to fresh company guidance.

Chinese Crackdown

Chinese technology stocks were under pressure last week as Chinese regulators continued their push to rein in large companies for reasons that include data security, abusive corporate behavior, financial stability, and curtailing private-sector power.

Chinese government actions raised new levels of concerns about which industries may next fall in the crosshairs of regulators. American investors have plenty of exposure to Chinese companies. Substantial losses were felt by mutual funds and hedge funds, which account for about 86% of the holdings in the over 200 U.S.-listed Chinese companies whose aggregate market capitalization exceeds $2 trillion.

This Week: Key Economic Data

Monday: ISM (Institute for Supply Management) Manufacturing Index.

Tuesday: Factory Orders.

Wednesday: ADP (Automated Data Processing) Employment Report. ISM (Institute for Supply Management) Services Index.

Thursday: Jobless Claims.

Friday: Employment Situation Report.

Source: Econoday, July 30, 2021

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Monday: Simon Property Group, Inc. (SPG).

Tuesday: Alibaba Group Holdings (BABA), Activision Blizzard, Inc. (ATVI), Amgen, Inc. (AMGN), Eli Lilly & Company (LLY), Diageo, PLC (DEO).

Wednesday: Roku, Inc. (ROKU), Prudential Financial, Inc. (PRU), CVS Health Corporation (CVS), General Motors, Inc. (GM), Etsy, Inc. (ETSY), Electronic Arts, Inc. (EA), MGM Resorts International (MGM), Match Group, Inc. (MTCH), Emerson Electric Co. (EMR), Booking Holdings (BKNG).

Thursday: Square, Inc. (SQ), Illumina, Inc. (ILMN), Duke Energy Corporation (DUK), Albemarle Corporation (ALB), Cigna Corporation (CI), Becton, Dickinson and Company (BDX), Regeneron Pharmaceuticals, Inc. (REGN).

Friday: Dominion Energy (D).

Source: Zacks, July 30, 2021

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.