The Weekly Update

Week of May 6th, 2024

By Christopher T. Much, CFP®, AIF®

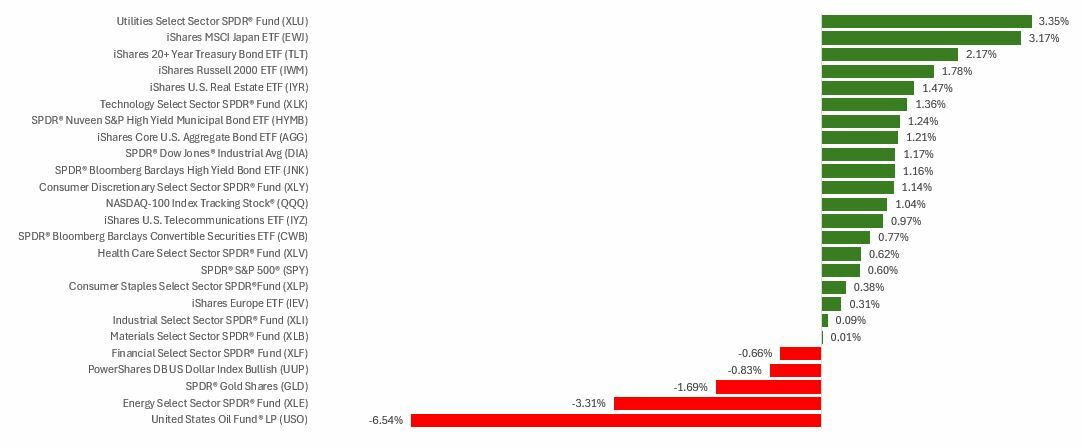

Stocks notched a solid gain last week, rallying behind upbeat earnings, a dovish Fed, and mixed economic data.

Stocks Pop, Drop, Then Rally

Markets began the week with an upward bump as positive news from some mega-cap tech companies outweighed disappointing updates from other tech names.

The tone quickly changed on Tuesday as higher-than-expected Q1 wage growth triggered inflation and interest-rate anxiety—just as the Federal Open Market Committee kicked off its third meeting of the year. Each of the three major averages dropped more than 1.5 percent on the last trading day of April.

When the Fed announced it was holding rates steady on Wednesday, stocks initially rallied on the news, but sellers got the upper hand late in the trading session, and prices ended the day slightly down.

On Thursday, stocks trended higher as more companies reported upbeat Q1 results. Then, on Friday, stocks pushed higher after the April jobs report indicated that unemployment ticked up and the economy slowed. The 175,000 jobs created in April represented slower growth than the over 300,000 added in March and less than the 240,000 economists expected. Some Fed watchers believe that the news bolstered chances that the Fed may adjust rates sooner rather than later.

Uncertain Hurtin’

Markets hate uncertainty, so Fed Chair Jerome Powell attempted to clarify the Fed’s stance on the outlook for interest rates at the close of its two-day meeting. Determining what’s next for interest rates in the context of stubborn inflation is no simple task. But Powell was as straightforward as possible at the press conference. “I think it’s unlikely that the next policy rate move will be a hike,” he said. “I’d say it’s unlikely.”

This Week: Key Economic Data

Wednesday: EIA Petroleum Report.

Thursday: Jobless Claims. EIA Natural Gas Report. Fed Balance Sheet.

Friday: Consumer Sentiment. Treasury Statement.

Source: Investor’s Business Daily – Econoday economic calendar; May 2, 2024

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Monday: Vertex Pharmaceuticals Incorporated (VRTX)

Tuesday: The Walt Disney Company (DIS), Arista Networks, Inc. (ANET)

Wednesday: Uber Technologies, Inc. (UBER), Airbnb, Inc. (ABNB), Shopify Inc. (SHOP), Emerson Electric Co. (EMR)

Source: Zacks, May 2, 2024

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.