The Weekly Update

Week of May 13th, 2024

By Christopher T. Much, CFP®, AIF®

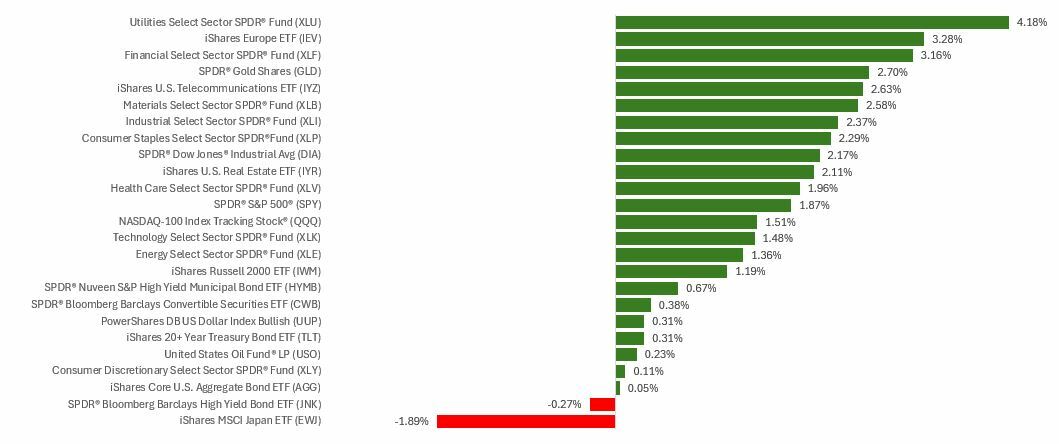

Stocks notched a solid gain last week as rate-cut expectations paced the rally as the Q1 earnings season wound down.

Stocks Climb Steadily

Monday opened with stocks picking up where they left off the prior Friday. Stocks were still basking in the afterglow of fresh jobs data, which eased investor concerns of an overheating economy. That and reports of a possible Middle East ceasefire fueled Monday’s rally.1

Stocks hung out in a narrow trading band Tuesday and Wednesday, yawning at the sparse economic news and a handful of negative earnings results. By contrast, the Nasdaq edged lower over those two days.

On Thursday, the S&P 500 closed above 5,200 for the first time since early April. The next day, stocks rallied, and the Dow clinched its eighth consecutive day of gains, the longest winning streak since December and its best weekly performance this year. Fresh data showed consumers continue to have inflation concerns for the year ahead, which was unsettling.

Jobs Market Shows A “Goldilocks” Outlook

Jobs data from the past few months have shown unemployment levels remain low while job growth stays strong—but not too hot.

And last week’s Conference Board’s employment trends index for April projected slower jobs growth in the second half. The markets all year have responded well when the “Goldilocks” outlook suggests that economic indicators are “just right.”

This Week: Key Economic Data

Monday: Fed Official Loretta Mester Speech.

Tuesday: Producer Price Index. NFIB Small Business Optimism Index.

Wednesday: Consumer Price Index. Retail Sales. Business Inventories. Fed Official Neel Kashkari Speech.

Thursday: Housing Starts. Jobless Claims. Industrial Production. Import & Export Prices. Fed Official Speeches: Patrick Harker, Raphael Bostic.

Friday: Leading Indicators.

Source: Investor’s Business Daily – Econoday economic calendar; May 10, 2024

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Tuesday: The Home Depot, Inc. (HD)

Wednesday: Cisco Systems, Inc. (CSCO)

Thursday: Walmart Inc. (WMT), Applied Materials, Inc. (AMAT), Deere & Company (DE)

Source: Zacks, May 10, 2024

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.