The Weekly Update

December 2nd, 2024

By Christopher T. Much, CFP®, AIF®

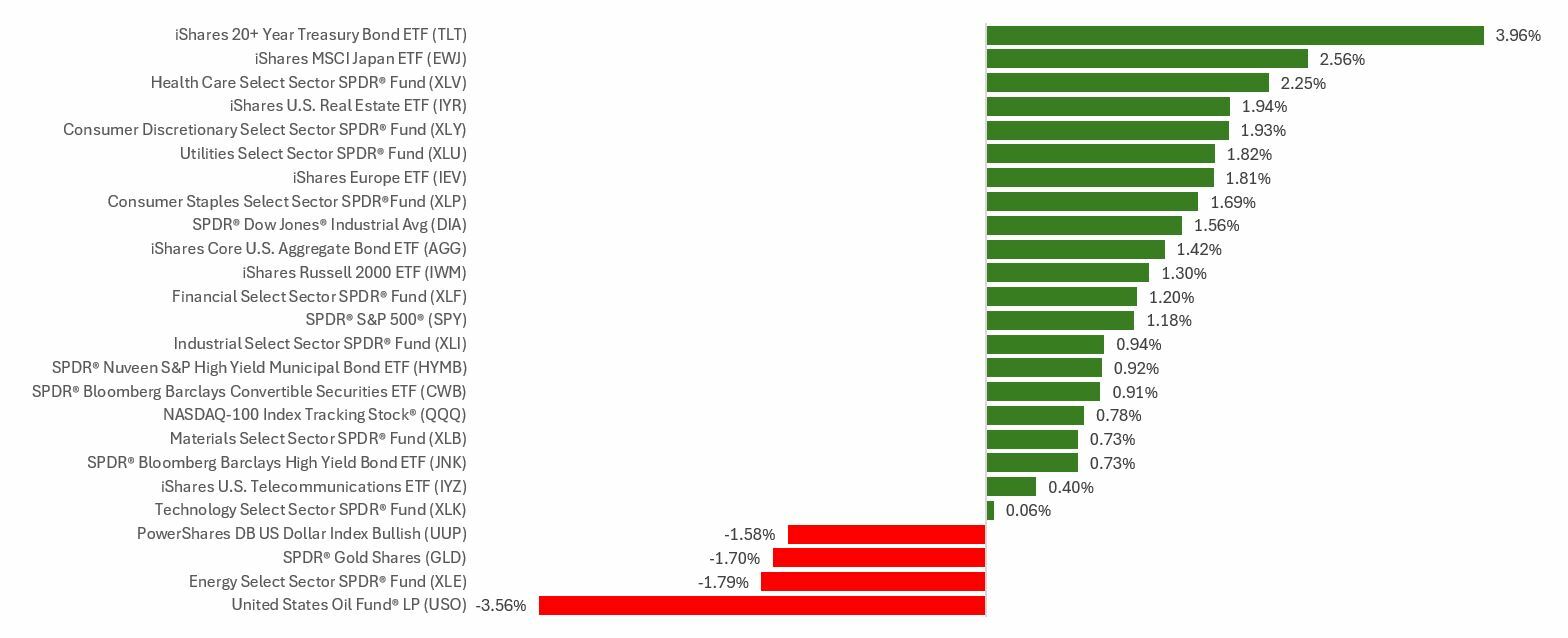

Stocks posted solid gains over a short and busy holiday week as investors parsed fresh economic data, comments on potential future trade policy, and a few Q3 reports from technology companies.

The Standard & Poor’s 500 Index gained 1.06 percent, while the Nasdaq Composite Index advanced 1.13 percent. The Dow Jones Industrial Average rose 1.39 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, added 2.02 percent.

Rally Extends

Stocks staged a broad-based rally to start the week as investors reacted to the nominee for Secretary of the Treasury. Small-cap stocks continued their month-to-date surge as the Russell 2000 Index rose to an all-time high. News that consumer confidence rose in November appeared to contribute to gains.

Then stocks took a pre-Thanksgiving pause as investors digested economic data. Also, disappointing Q3 updates from two computer hardware manufacturers weighed on the tech sector in pre-Thanksgiving trading.

Semiconductor stocks rallied on Friday, pushing all three averages higher for a second straight week. The Dow cracked 45,000 for the first time, and the S&P 500 hit a new record high—with each index closing out its best month of 2024.

Tariff Talk

Some of the post-election rally has been driven by investor expectations for less regulation and lower corporate taxes proposed by the incoming administration. One area of concern has been the economic impact of proposed tariffs.

Some market observers believe that the markets have already priced in the impact of these tariffs. In contrast, others see a new Treasury Secretary as a potential buffer in the tariff talks.

This Week: Key Economic Data

Monday: ISM Manufacturing Index. Construction Spending. Fed Official John Williams speaks.

Tuesday: Motor Vehicle Sales. Fed Official Austan Goolsbee speaks.

Wednesday: ADP Employment Report. Fed Official Alberto Musalem speaks. Factory Orders. EIA Petroleum Status Report.

Thursday: Jobless Claims. International Trade in Goods and Services. Fed Official Thomas Barkin speaks. Fed Balance Sheet.

Friday: Employment Situation. Consumer Sentiment. Fed Officials Mary Daly, Beth Hammack and Austan Goolsbee speak.

Source: Investor’s Business Daily – Econoday economic calendar; November 29, 2024

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Tuesday: Salesforce Inc. (CRM), Marvell Technology, Inc. (MRVL)

Wednesday: Synopsys, Inc. (SNPS)

Thursday: The Kroger Co. (KR)

Source: Zacks, November 29, 2024

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.