The Weekly Update

Week of March 3rd, 2025

By Christopher T. Much, CFP®, AIF®

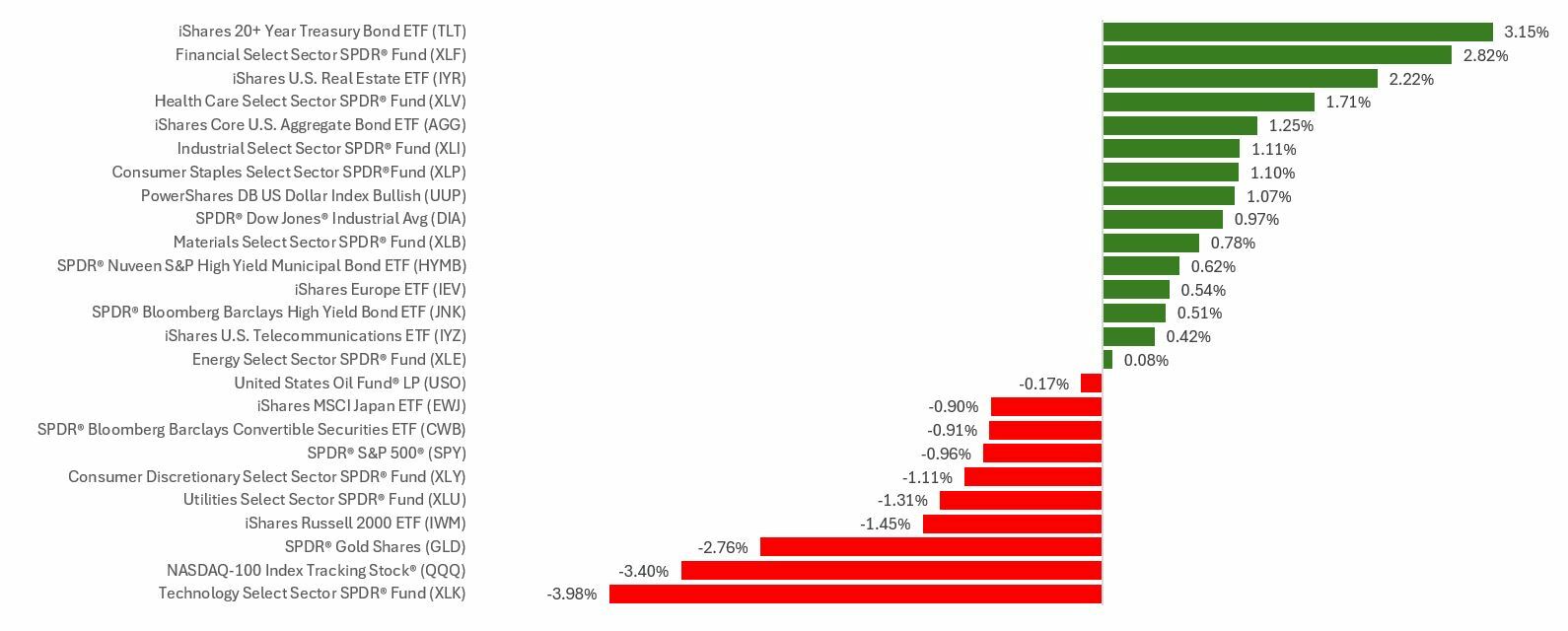

Stocks were mixed last week as investor concerns over inflation and trade policy combined to produce another volatile trading week.

The Dow Jones Industrial Average rose 0.95 percent, while the Standard & Poor’s 500 Index lost 0.98 percent. Meanwhile, the tech-heavy Nasdaq Composite Index dropped an eye-catching 3.47 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, lost 1.03 percent.

Trade Talk

The week began under pressure after the White House said 25 percent tariffs on Mexico and Canada would begin after the 30-day pause ends in early March.

On Tuesday, S&P and Nasdaq stocks continued their slide on news that consumer confidence weakened more than expected. Concerns about inflation and tariffs merged with investors fretting over economic growth and global trade. It was the fourth straight day of declines for the S&P 500 and Nasdaq. The Dow, however, advanced for its third consecutive session.

After a quiet Wednesday, stock fell broadly on Thursday after the White House announced additional tariffs on goods from China and Europe. A large chip maker prominent in artificial intelligence (AI) matters produced a mixed corporate report for Q4, which put some pressure on the broader market.

Friday’s news that inflation moderated boosted stocks, with prices accelerating higher into the close of trading. The Fed’s favorite core inflation measure hit 2.6 percent in January, which aligns with forecasts.

Getting a Read on Tariffs

Markets dislike uncertainty, so steady trade talk produces volatile intra-week trading. Investors don’t know what tariffs will be enforced versus which ones are part of an ongoing negotiation, which can produce unsettling price swings.

S&P 500 companies echo some of that uncertainty. At last check, 146 have mentioned the term “tariff” or “tariffs” on Q4 conference calls with shareholders–the highest level since Q2 2019.

This Week: Key Economic Data

Monday: ISM Manufacturing. Construction Spending.

Tuesday: Auto Sales. New York Fed President Williams speaks.

Wednesday: ADP Employment Report. Factory Orders. ISM Services Index.

Thursday: Productivity. Trade Deficit. Wholesale Inventories.

Friday: Employment Situation. Consumer Credit. New York Fed President Williams speaks.

Source: Investor’s Business Daily – Econoday economic calendar; February 27, 2025

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Tuesday: CrowdStrike (CRWD), Target Corporation (TGT), AutoZone, Inc. (AZO)

Wednesday: Marvell Technology, Inc. (MRVL)

Thursday: Broadcom Inc. (AVGO), Costco Wholesale Corporation (COST)

Source: Zacks, February 27, 2025

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.