The Weekly Update

Week of March 13th, 2023

By Christopher T. Much, CFP®, AIF®

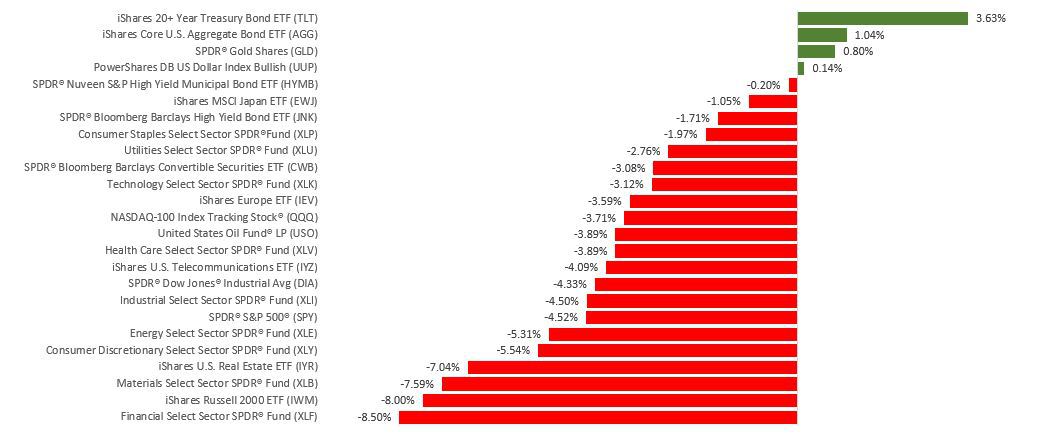

Stocks tumbled last week as investors reconsidered their interest rate expectations after Fed Chair Powell’s Congressional testimony that rates may need to go higher. Stocks also were rattled when a west coast bank was placed into receivership on Friday following a run on deposits.

The Dow Jones Industrial Average dropped 4.44%, while the Standard & Poor’s 500 lost 4.55%. The Nasdaq Composite index fell 4.71% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, slipped 0.37%.

Rate Fears, Bank Scare

Congressional testimony on Tuesday by Fed Chair Jerome Powell that interest rates may require a higher increase faster than planned unnerved investors, dimming the hopes of any pause in rate hikes this summer. After stabilizing the following day, stocks trended lower as the financial sector came under pressure. The lower move was triggered by a specialty bank’s liquidity issues, though regional and money center banks could not escape the selling.

Labor market strength in a Friday report exacerbated rate-hike anxieties, though cooling wage gains balanced an above-consensus new jobs number. Markets appeared to take the employment report in stride but fell on worries arising from the shutdown of a tech-centric bank.

Powell’s Congressional Testimony

Fed Chair Powell last week testified on Capitol Hill during which he acknowledged that the economy was running hotter than he had expected. He said that labor market strength and stubbornly elevated inflation may require the Fed to raise rates quicker than anticipated and above levels previously contemplated.

The market did not respond well to Powell’s change of tone. Many now see the potential of a 0.50% rate hike coming out of the Federal Open Market Committee’s (FOMC) March 21-22 meeting instead of the expected increase of 0.25%. Powell did say that the FOMC would consider the monthly employment report released last Friday and upcoming inflation reports before arriving at a decision.

This Week: Key Economic Data

Tuesday: Consumer Price Index (CPI).

Wednesday: Producer Price Index (PPI). Retail Sales.

Thursday: Jobless Claims. Housing Starts.

Friday: Industrial Production. Consumer Sentiment. Index of Leading Economic Indicators.

Source: Econoday, March 11, 2023

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Wednesday: Adobe, Inc. (ADBE), Lennar Corporation (LEN).

Thursday: FedEx Corporation (FDX), Dollar General Corporation (DG).

Source: Zacks, March 11, 2023

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.