The Weekly Update

Week of October 3rd, 2022

By Christopher T. Much, CFP®, AIF®

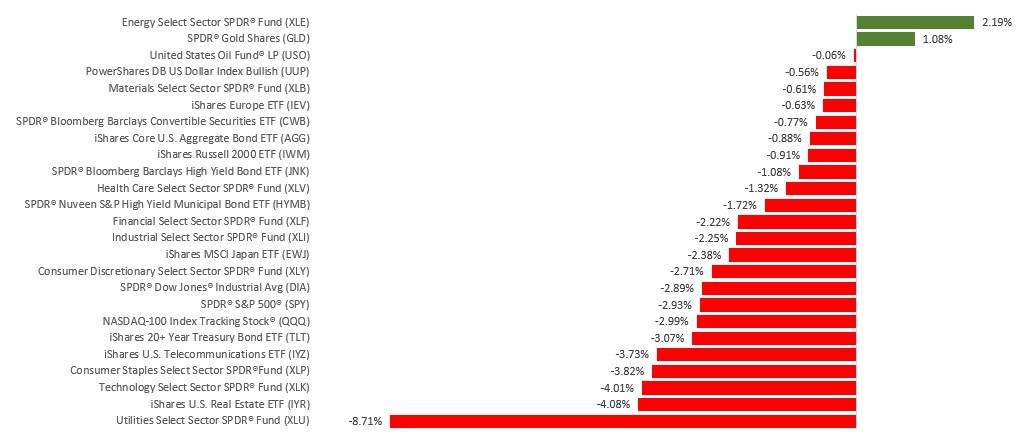

Rising recession fears and uncertainty in the bond and currency markets sent stocks to new 2022 lows last week.

The Dow Jones Industrial Average declined 2.92%, while the Standard & Poor’s 500 slumped 2.91%. The Nasdaq Composite index fell 2.69%. The MSCI EAFE index, which tracks developed overseas stock markets, lost 1.94%.

A Tumultuous Week

U.S. stocks were under pressure all week due to recession concerns and unsettled trading in the bond and currency markets. This stress followed economic steps out of the U.K. During the previous week, the Bank of England (BOE) raised interest rates, and its prime minister announced unfunded tax cuts that the markets interpreted as inflationary.

U.S. bond yields rose early last week, sending stocks lower until Wednesday’s rally following news that the BOE would buy U.K. government bonds. U.S. stocks resumed their descent the following two days to close out a disappointing week, month, and third quarter.

The Bank of England Acts

Global bond and currency markets have been volatile recently due to global central bankers raising interest rates to combat inflation. Developments in the U.K. took center stage last week when the BOE announced it would be buying long-dated U.K. government bonds. Upending the financial markets was the previous week’s announcement of tax cuts by the country’s new prime minister, a step many investors viewed as counterproductive to the BOE’s inflation-fighting efforts.

The BOE’s decision to begin temporary purchases of government bonds was well-received by capital markets, sending U.K. bond yields lower and boosting U.K. stock prices in the immediate aftermath.

This Week: Key Economic Data

Monday: Institute for Supply Management (ISM) Manufacturing Index.

Tuesday: Factory Orders. Job Openings and Labor Turnover Survey (JOLTS).

Wednesday: Automated Data Processing (ADP) Employment Report. Institute for Supply Management (ISM) Services Index.

Thursday: Jobless Claims.

Friday: Employment Situation.

Source: Econoday, September 30, 2022

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Thursday: Constellation Brands, Inc. (STZ), McCormick & Company, Inc. (MKC), Conagra Brands (CAG).

Source: Zacks, September 30, 2022

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.