The Weekly Update

Week of May 16th, 2022

By Christopher T. Much, CFP®, AIF®

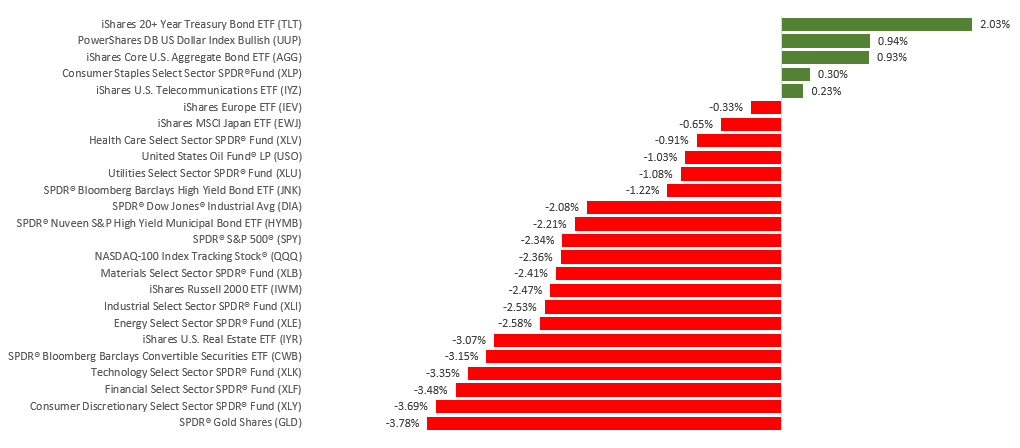

In a volatile trading week, stocks extended their losses as economic growth and inflation concerns soured investor sentiment.

The Dow Jones Industrial Average dropped 2.14%, while the Standard & Poor’s 500 lost 2.41%. The Nasdaq Composite index fell 2.80% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, slumped 3.21%.

A Turbulent Week

Inflation moved to center stage last week with the release of April’s Consumer Price Index (CPI) and the Producer Price Index. Both numbers came near their 40-year highs but were lower than March’s year-over-year numbers. The results heightened investor anxiety about future Fed monetary tightening and its impact on economic growth.

In recent weeks, technology stocks have borne the brunt of the downdraft as investors lightened up on risk exposures, with some of the mega-cap tech names getting swept up in the selling pressure. Cooling import price increases buoyed spirits on Friday, helping spark a rally that reduced the week’s losses.

Inflation Stays Hot

Investors were greeted with a mixed CPI report, looking for signs that inflation may be cooling. Year-over-year costs rose 8.3%, slower than the previous month but faster than consensus estimates. Excluding food and energy, core inflation climbed 6.2%. Buried beneath the headline number was a 5.1% yearly increase in shelter costs, the most significant increase since 1991. Shelter costs account for one-third of the CPI.

Inflation has been a weight on markets all year. Investors are concerned that the persistence of higher prices may tip the economy into recession as increased spending on essential needs crimps consumers’ spending power.

This Week: Key Economic Data

Tuesday: Retail Sales. Industrial Production.

Wednesday: Housing Starts.

Thursday: Existing Home Sales. Jobless Claims. Index of Leading Economic Indicators.

Source: Econoday, May 13, 2022

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Tuesday: Walmart, Inc. (WMT), The Home Depot, Inc. (HD).

Wednesday: Cisco Systems, Inc. (CSCO), Target Corporation (TGT), Lowe’s Companies, Inc. (LOW), The TJX Companies, Inc. (TJX), Analog Devices, Inc. (ADI).

Thursday: Applied Materials, Inc. (AMAT), Palo Alto Networks, Inc. (PANW), Ross Stores, Inc. (ROST).

Friday: Deere & Company (DE).

Source: Zacks, May 13, 2022

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.