The Weekly Update

Week of February 17th, 2025

By Christopher T. Much, CFP®, AIF®

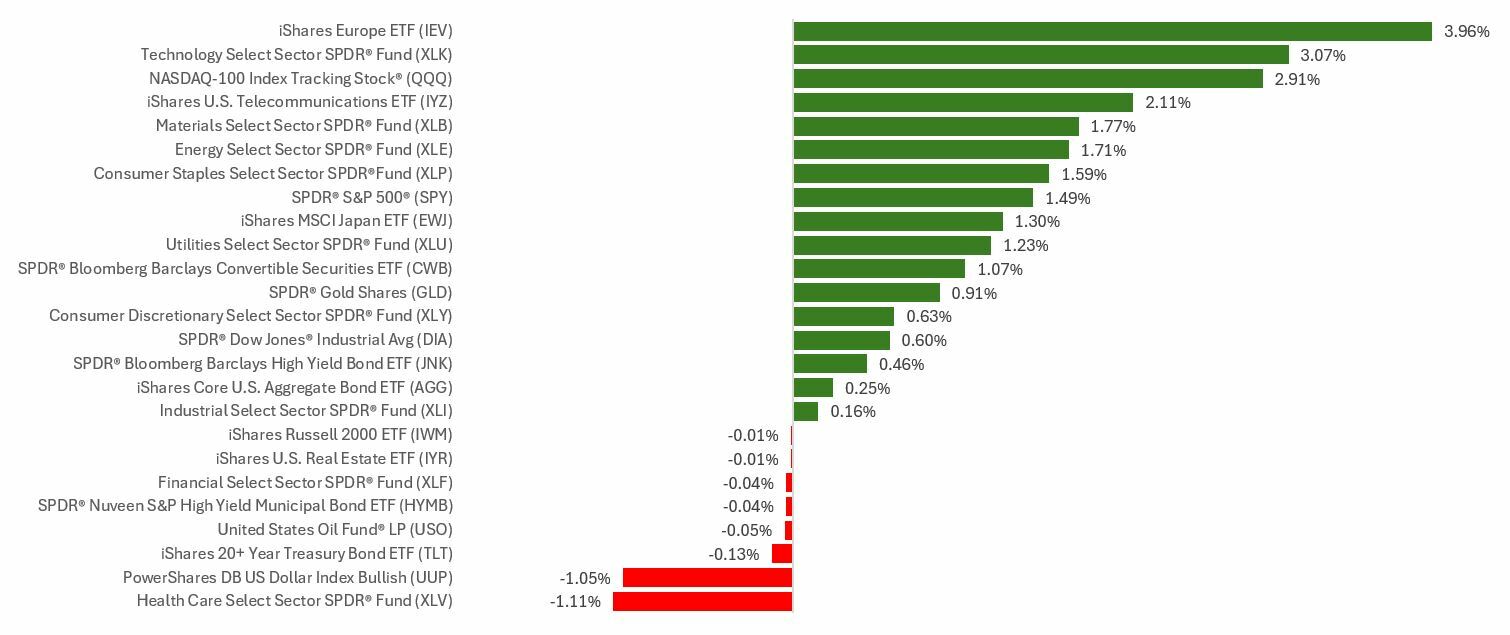

Stocks advanced last week despite some intra-week volatility as investors showed concern about the economy’s strength.

The Standard & Poor’s 500 Index gained 1.47 percent, while the Nasdaq Composite Index picked up 2.58 percent. The Dow Jones Industrial Average added 0.55 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, tacked on 2.53 percent.

The Fed Is in “No Hurry”

Stocks opened the week higher, quickly discounting news that the White House would impose 25 percent tariffs on all steel and aluminum imports. Tuesday was a volatility session, punctuated by comments from Fed Chair Powell, who told lawmakers the central bank doesn’t “need to be in a hurry” to lower interior rates further.

Stocks opened lower Wednesday after a warmer-than-expected update on consumer prices. But stocks showed some resilience and rallied throughout the day. The Nasdaq managed to claw back its losses before Wednesday’s close.

On Thursday, the White House announced a plan for reciprocal tariffs (levies on goods imported into the U.S. from countries that impose tariffs on U.S.-exported goods). But markets rallied on news that the administration would pause tariffs until they determine how much to levy on each country. Stocks took a breather on Friday, shrugging off a weaker-than-expected retail sales report.

The S&P ended shy of a record close, and the Nasdaq finished the week above the 20,000 mark.

Inflation in Focus

The Consumer Price Index report showed prices rose 0.5 percent in January–slightly hotter than expected. Shelter costs remained elevated, increasing 0.4 percent for the month.

Core CPI, which excludes volatile food and energy prices, was also above forecast. Food prices rose 0.4 percent, pushed by a 15.2 percent increase in egg prices related to ongoing issues forcing farmers to cull chicken flocks. Energy prices picked up 1.1 percent as gasoline prices rose.

This Week: Key Economic Data

Tuesday: Homebuilder Confidence Index. San Francisco Fed President Mary Daly speaks.

Wednesday: Housing Starts & Building Permits. Minutes from January Fed meeting.

Thursday: Weekly Jobless Claims. Leading Economic Indicators. Fed Officials Austan Goolsbee and Alberto Musalem speak.

Friday: Existing Home Sales. Consumer Sentiment.

Source: Investor’s Business Daily – Econoday economic calendar; February 14, 2025

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Tuesday: Arista Networks, Inc. (ANET), Medtronic (MDT)

Wednesday: Analog Devices, Inc. (ADI)

Thursday: Walmart Inc. (WMT), Booking Holdings Inc. (BKNG), The Southern Company (SO)

Source: Zacks, February 14, 2025

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

Past performance is no guarantee of future results. Data collected from Investors FastTrack software.

CNBC.com, February 11, 2025

CNBC.com, February 14, 2025

Investing.com, February 14, 2025

MarketWatch.com, February 10, 2025

The Wall Street Journal, February 12, 2025

The Wall Street Journal, February 14, 2025