The Weekly Update

Week of November 25th, 2024

By Christopher T. Much, CFP®, AIF®

Stocks advanced last week, powering ahead with pre-holiday optimism despite geopolitical tensions and two disappointing Q3 corporate updates.

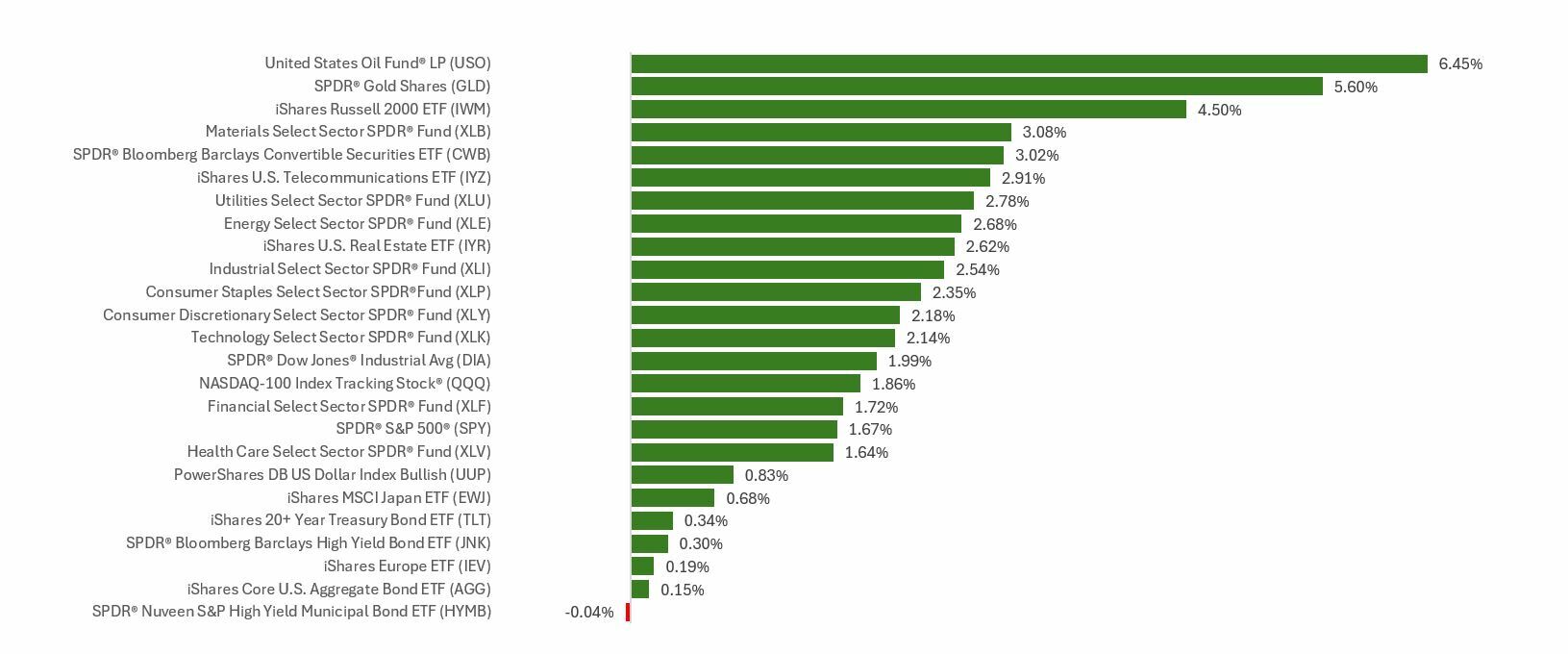

The Standard & Poor’s 500 Index rose 1.68 percent, while the Nasdaq Composite Index gained 1.73 percent. The Dow Jones Industrial Average led, picking up 1.96 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, was flat (-0.05 percent).

Stock Push Ahead

Stocks showed mixed results during the first half of the week due to geopolitical tensions that boosted precious metals and put pressure on Treasury yields.

The Dow Industrials jumped out in front midweek and never looked back. Disappointing earnings on Tuesday from a large box retailer held back some gains in the broader S&P 500. A mixed Q3 update report from the nation’s leading AI chipmaking company also tempered gains a bit.

Year-end optimism, especially around consumers driving a healthy holiday shopping season, supported the rally for much of the week. Fresh data that weekly jobless claims dropped to a seven-month low also lifted spirits.

Small-Cap Focus

For several weeks, investors have favored small-cap names over larger-cap issues. This trend was again on display last week.

The Russell 2000, an index of 2,000 small-cap companies widely used as a benchmark for U.S. small-cap stocks, rose 4.50 percent for the five days of trading. In the month-to-date through November 22, the Russell is up nearly 9 percent.

This Week: Key Economic Data

Tuesday: Consumer Confidence. New Home Sales. FOMC Minutes.

Wednesday: Gross Domestic Product (GDP). Durable Goods. Pending Home Sales. Personal Income and Outlays.

Thursday: Markets Closed—Thanksgiving Holiday.

Source: Investor’s Business Daily – Econoday economic calendar; November 21, 2024

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Monday: Agilent Technologies, Inc. (A)

Tuesday: Analog Devices, Inc. (ADI), Dell Technologies Inc. (DELL), CrowdStrike (CRWD)

Source: Zacks, November 21, 2024

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.