The Weekly Update

Week of June 1st, 2021

By Christopher T. Much, CFP®, AIF®

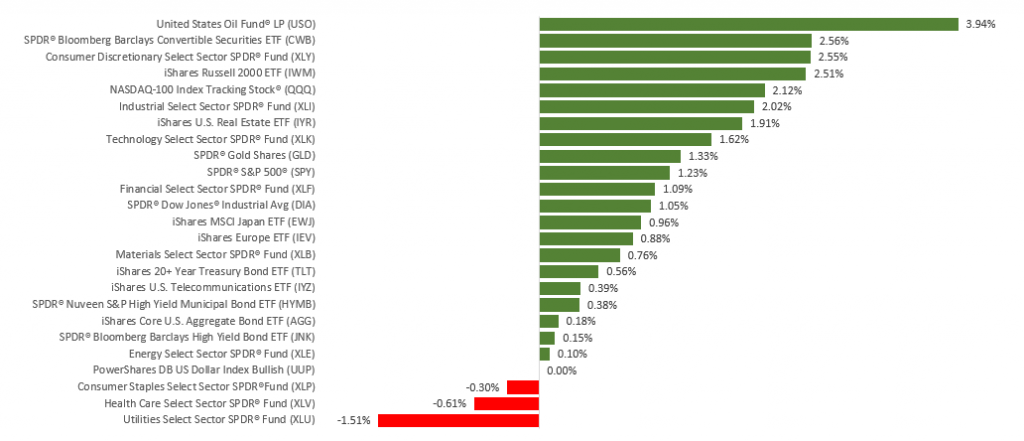

Optimism over the economic reopening and renewed enthusiasm for technology and other high-growth companies powered the stock market higher last week.

The Dow Jones Industrial Average rose 0.94%, while the Standard & Poor’s 500 climbed 1.16%. The Nasdaq Composite index led, picking up 2.06%. The MSCI EAFE index, which tracks developed overseas stock markets, added 0.46%.

Solid Gains

Stocks rallied on renewed confidence in the economic recovery, lower inflation worries, and rising comfort with Fed officials talking about the potential for easing of its monthly bond purchases. Technology, communication services, and reopening stocks were among the market leaders.

Investor sentiment was buoyed late in the week by an encouraging jobless claims number and the unveiling of a Republican infrastructure proposal. A somewhat hotter-than-expected inflation indicator on Friday did nothing to dampen optimism as stocks added to their gains ahead of the three-day Memorial Day weekend.

Jobless Claims Reach Pandemic Lows

In a sign of further recovery in the labor market, the number of initial jobless claims fell to a pandemic low, continuing the downward trend in worker layoffs. New jobless claims totaled 406,000 for the week, well below the pandemic high of nearly 1.5 million, though still above the 2019 weekly average of 218,000.

Final Thoughts

The history of Memorial Day extends back to the Civil War when it was referred to as Decoration Day. We join all Americans in honoring those who died in the performance of their military service to protect the freedoms we enjoy today. These were remarkably brave men and women whose sacrifice will never be forgotten.

This Week: Key Economic Data

Tuesday: Institute for Supply Management (ISM) Manufacturing Index.

Wednesday: Automated Data Processing (ADP) Employment Report.

Thursday: Jobless Claims. Institute for Supply Management (ISM) Services Index.

Friday: Employment Situation. Factory Orders.

Source: Econoday, May 28, 2021

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Tuesday: Zoom Video Communications, Inc. (ZM).

Wednesday: Splunk (SPLK).

Thursday: Lululemon Athletica (LULU), Broadcom (AVGO), Docusign, Inc. (DOCU), CrowdStrike Holdings (CRWD).

Source: Zacks, May 28, 2021

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.