The Weekly Update

Week of March 17th, 2025

By Christopher T. Much, CFP®, AIF®

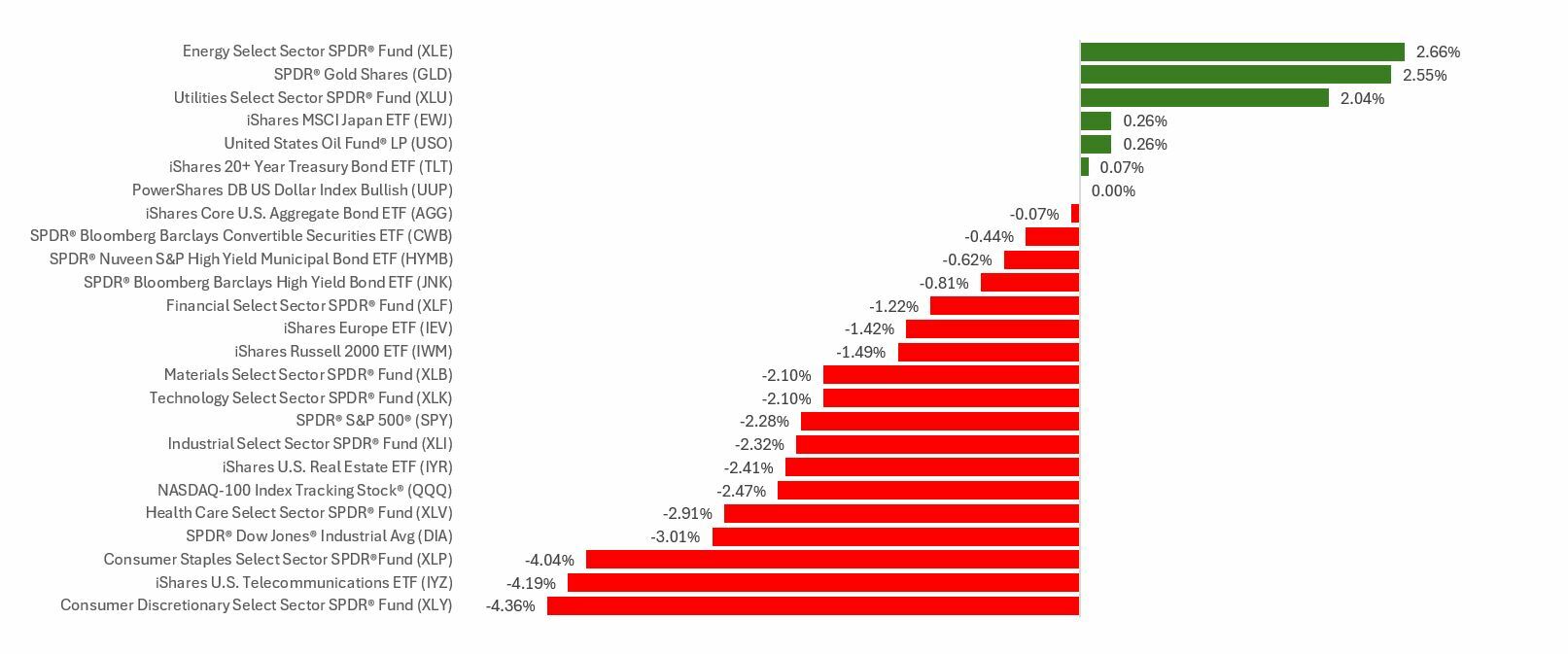

Investors endured another volatile, whipsaw week as ongoing trade talks and White House comments about the economy unsettled investors.

The Standard & Poor’s 500 Index declined 2.27 percent, while the Nasdaq Composite Index dropped 2.43 percent. The Dow Jones Industrial Average fell 3.07 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, lost 0.95 percent.

Markets Stem Losses

Stocks opened the week lower as investors reacted to the president’s weekend comments about the economy. Then, U.S. and Canadian leaders traded additional tariff threats, riling up anxious investors.3,4

Stocks rebounded midweek after a cooler-than-expected Consumer Price Index (CPI) report eased growing inflation concerns.

The broad market slide resumed Thursday, but better-than-expected February wholesale inflation data helped buffer losses. The S&P 500 ended Thursday in correction territory—10 percent below its February 19 record close.

Markets pushed higher Friday, clawing back some losses for the week. News of progress in resolving the federal government shutdown soothed investors’ nerves.

Sunny Side ‘Down’

Fewer CPI constituents garner more attention from consumers right now than the price of eggs. Avian bird flu—and the subsequent culling of millions of chickens—was primarily to blame for prices rising 15 percent in January and another 10 percent in February. While recent evidence suggests prices have dropped, the cost of eggs remains a sticky issue—even though prices of many other items have risen just as much, if not more.

So why do consumers appear to be overly uneasy?

One theory is that eggs symbolize something more significant. Not only are eggs a critical, inexpensive source of protein and nutrients for millions of consumers, but they are also a core part of many other foods made at home or mass-produced. For that reason, eggs are a mental proxy for how consumers believe the broader economy is doing.

This Week: Key Economic Data

Monday: Retail Sales. Business Inventories. Homebuilder Confidence Index.

Tuesday: Housing Starts and Permits. Import & Export Prices. Industrial Production. Capacity Utilization. Federal Open Market Committee (FOMC) meeting—Day 1.

Wednesday: FOMC meeting—Day 2. Fed Announcement/ Fed Chair Press Conference.

Thursday: Existing Home Sales. Weekly Jobless Claims. Leading Indicators.

Friday: Federal Reserve Official John Williams speaks.

Source: Investor’s Business Daily – Econoday economic calendar; March 13, 2025

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Wednesday: General Mills, Inc. (GIS)

Thursday: Nike, Inc. (NKE), Micron Technology, Inc. (MU), FedEx Corporation (FDX)

Source: Zacks, March 13, 2025

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.