The Weekly Update

Week of September 5th, 2023

By Christopher T. Much, CFP®, AIF®

Falling bond yields–spurred by weak economic data–helped lift stocks to weekly gains.

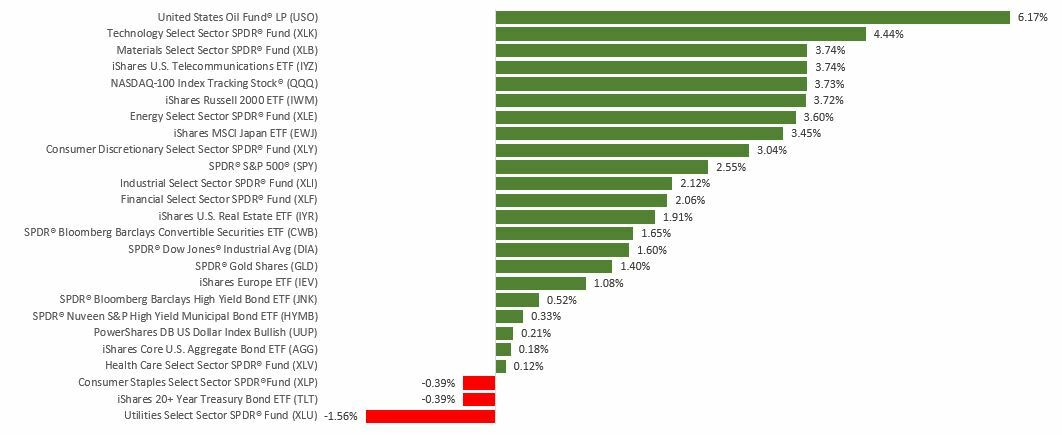

The Dow Jones Industrial Average advanced 1.43%, while the Standard & Poor’s 500 gained 2.50%. The Nasdaq Composite index increased 3.25% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, picked up 2.71%.

Stocks Rise on Slowing Economy

Investor sentiment turned positive last week as signs of economic softness were interpreted as reasons for the Fed to hold off on further rate hikes. A downward revision of Q2 economic growth and fresh signs of a cooling labor market reversed the recent rise in bond yield. They helped trigger a stock bounce back following Fed Chair Powell’s speech at Jackson Hole the previous Friday.

It wasn’t all about bad news being viewed as good news, though. A series of solid earnings reports, an announcement by one mega-cap tech name introducing pricing for its AI tools, and fresh inflation data–in-line with market expectations–further boosted enthusiasm for stocks.

Signs of Labor Cooling

Despite historic monetary tightening, the labor market has exhibited remarkable resilience, but last week’s employment data showed a cooling trend.

Job openings declined to their lowest level since March 2021, though they remained above pre-pandemic levels. Meanwhile, a survey of private sector hiring showed a slowdown in hiring, with employers adding 177,000 jobs in August–below the 371,000 added in July and short of economists’ forecast of 200,000.

Finally, the government’s monthly employment report showed the number of nonfarm payroll gains continued to decelerate in August, while June and July estimates were revised lower by 110,000.

This Week: Key Economic Data

Tuesday: Factory Orders.

Wednesday: Institute for Supply Management (ISM) Services Index.

Thursday: Jobless Claims.

Friday: Consumer Credit.

Source: Econoday, September 1, 2023

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts are also subject to revision.

This Week: Companies Reporting Earnings

Tuesday: Zscaler, Inc. (ZS)

Thursday: DocuSign (DOCU)

Friday: The Kroger Co. (KR)

Source: Zacks, September 1, 2023

The companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.