The Weekly Update

Week of November 27th, 2023

By Christopher T. Much, CFP®, AIF®

Investor enthusiasm for stocks remained strong last week, buoyed by declining bond yields in a holiday-abbreviated trading week.

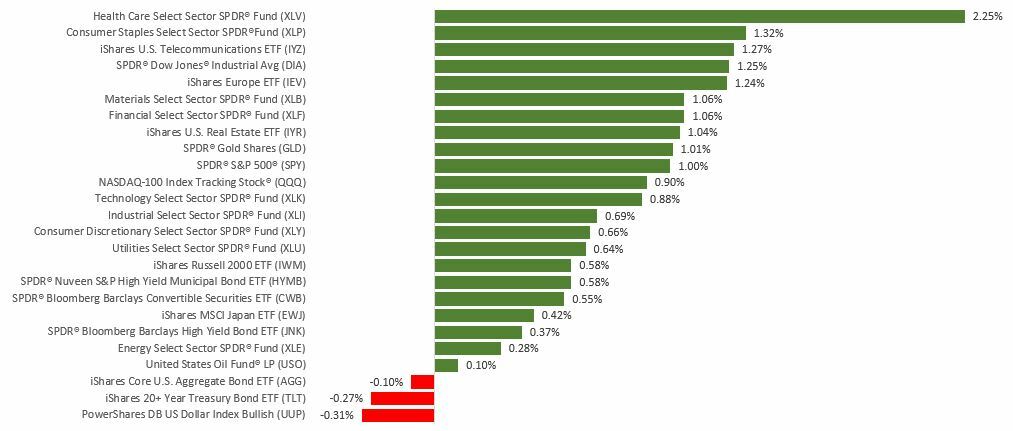

The Dow Jones Industrial Average picked up 1.27%, while the Standard & Poor’s 500 gained 1.00%. The Nasdaq Composite index rose 0.89% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, was flat (+0.03%).

Falling Yields Lift Stocks

The stock market continued to look toward the bond market for direction, responding positively to bond yields that fell steadily for much of the week. A successful 20-year Treasury notes auction on Monday triggered a decline in bond yields. The release of the minutes from the Fed’s last meeting buoyed investor optimism that the potential for further rate hikes was diminishing.

Investor sentiment was also lifted by the earnings results from a leading mega-cap, AI-enable chipmaker that topped analysts’ expectations, bolstering the narrative of AI’s potential to help corporate profits. Despite a higher turn in bond yields on the final half-day of trading, stocks retained the week’s gains.

Fed Minutes

Minutes from the October 31–November 1 meeting of the Federal Open Market Committee were released last week, providing insight into its decision not to raise rates and its thinking on the future direction of interest rates.

The minutes reflected concerns among committee members that inflation remained stubborn and may move higher. The minutes also reaffirmed the messaging of many Fed officials, including Fed Chair Powell, that monetary policy must remain restrictive until they are convinced inflation will be on track for the Fed’s two percent target. They further said that future rate decisions will be based on fresh economic data, offering no indication that a rate cut was forthcoming, as many analysts are increasingly anticipating for 2024.

This Week: Key Economic Data

Monday: New Home Sales.

Tuesday: Consumer Confidence.

Wednesday: Gross Domestic Product (GDP).

Thursday: Personal Income and Outlays. Jobless Claims.

Friday: Institute for Supply Management (ISM) Manufacturing Index.

Source: Econoday, November 24, 2023

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts are also subject to revision.

This Week: Companies Reporting Earnings

Wednesday: Dollar Tree, Inc. (DLTR), Synopsys, Inc. (SNPS)

Thursday: Salesforce, Inc. (CRM), Marvell Technology, Inc. (MRVL), Dell Technologies, Inc. (DELL)

Source: Zacks, November 24, 2023

The companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.