The Weekly Update

Week of November 4th, 2024

By Christopher T. Much, CFP®, AIF®

Stocks slid last week as mixed economic data and strong-but-not-spectacular Q3 corporate reports failed to inspire investors.

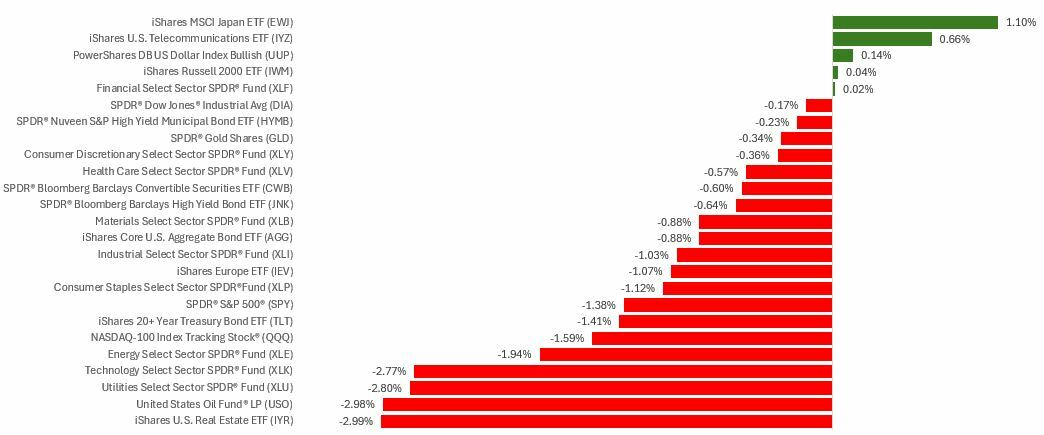

The Standard & Poor’s 500 Index fell 1.36 percent, while the Nasdaq Composite Index declined 1.50 percent. The Dow Jones Industrial Average edged down 0.15 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, slid 0.96 percent.

Q3 Reports Uninspired

Stocks rallied early Wednesday after the gross domestic product report showed a strong economy that appeared on the path to a soft landing. However, stocks moved lower throughout the day as investors digested mixed Q3 reports from a few mega-cap tech names.

Stocks were under more pressure Thursday as disappointing outlooks for some key tech companies pulled the market down. A softer-than-expected jobs report on Friday unsettled investors, but stocks picked up as the day progressed, and attention shifted to how the Fed may interpret the jobs data.

By Friday, the Nasdaq’s eight-week winning streak had ended, and the S&P fell for the second week.

Fed Back in Focus After Jobs Report

At its most recent meetings, the Fed has made it clear that it needed to balance the risks of both inflation and employment.

So, Friday’s jobs report that showed 12,000 jobs created in October caught some by surprise. Economists expected the Labor Department to report 100,000, down from September’s 223,000 jobs.

Investors parsed the data and determined the strike at a major aircraft manufacturer and two hurricanes caused the jobs report to fall short of estimates. Investors also appeared to believe the jobs report would prompt the Fed to move on rates at its two-day policy meeting, which ends on November 7.

This Week: Key Economic Data

Monday: Motor Vehicle Sales. Factory Orders.

Tuesday: Election Day.

Wednesday: FOMC Meeting – Day 1. EIA Petroleum Status Report.

Thursday: FOMC Meeting – Day 2. FOMC Announcement. Fed Chair Press Conference. Productivity and Costs.

Friday: Consumer Sentiment. Fed Official Michelle Bowman speaks.

Source: Investor’s Business Daily – Econoday economic calendar; November 1, 2024

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Monday: Vertex Pharmaceuticals Incorporated (VRTX)

Tuesday: Apollo Global Management Inc. (APO)

Wednesday: Qualcomm Incorporated (QCOM), Gilead Sciences, Inc. (GILD)

Thursday: Arista Networks, Inc. (ANET), Duke Energy Corporation (DUK), Airbnb, Inc. (ABNB)

Source: Zacks, November 1, 2024

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.