The Weekly Update

Week of September 11th, 2023

By Christopher T. Much, CFP®, AIF®

Concerns that the Fed may raise interest rates soured investor sentiment, sending stocks lower in a holiday-shortened trading week.

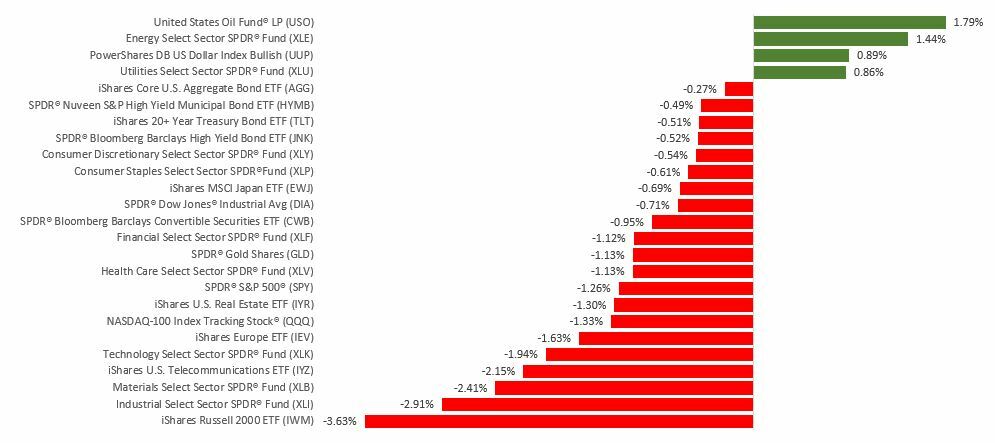

The Dow Jones Industrial Average slipped 0.75%, while the Standard & Poor’s 500 declined 1.29%. The Nasdaq Composite index dropped 1.93% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, lost 1.28%.

Stocks Resumed Their Decline

Stocks were bedeviled by rising bond yields and higher oil prices last week, with technology shares bearing the brunt of the decline. Hopes that the Fed may not find it necessary to raise interest rates were dented by economic data reflecting higher prices, rising labor costs, and fewer-than-forecast initial jobless claims.

The inflationary implications of higher oil prices also contributed to the growing sense that the Fed may implement additional rate hikes. While bond traders generally still expect no rate hike in September, the likelihood of a 0.25% rate hike or higher in November jumped to 43.3% by Friday morning from 35.4% a week ago.

Oil Prices Spike

Last week, Saudi Arabia and Russia announced they would extend their oil production cuts to the end of the year. Investors had expected these cuts to be stretched to October, so the three-month extension surprised the markets.

The announcement sent oil prices higher on supply shortage worries in the coming winter months, with the West Texas Intermediate (WTI) oil price climbing to a 10-month high.

Higher oil prices also sparked concerns that it would make the Fed’s inflation fight more difficult, potentially forcing the Fed to hike rates above market expectations.

This Week: Key Economic Data

Wednesday: Consumer Price Index (CPI).

Thursday: Jobless Claims. Producer Price Index (PPI). Retail Sales.

Friday: Consumer Sentiment. Industrial Production.

Source: Econoday, September 8, 2023

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts are also subject to revision.

This Week: Companies Reporting Earnings

Thursday: Adobe, Inc. (ADBE)

Source: Zacks, September 8, 2023

The companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.